31+ imrf pension calculator tier 2

Effective January 1 2011 IMRF assigns a benefit tier to a member when he or she is enrolled in IMRF. But remember that this amount does not include overtime.

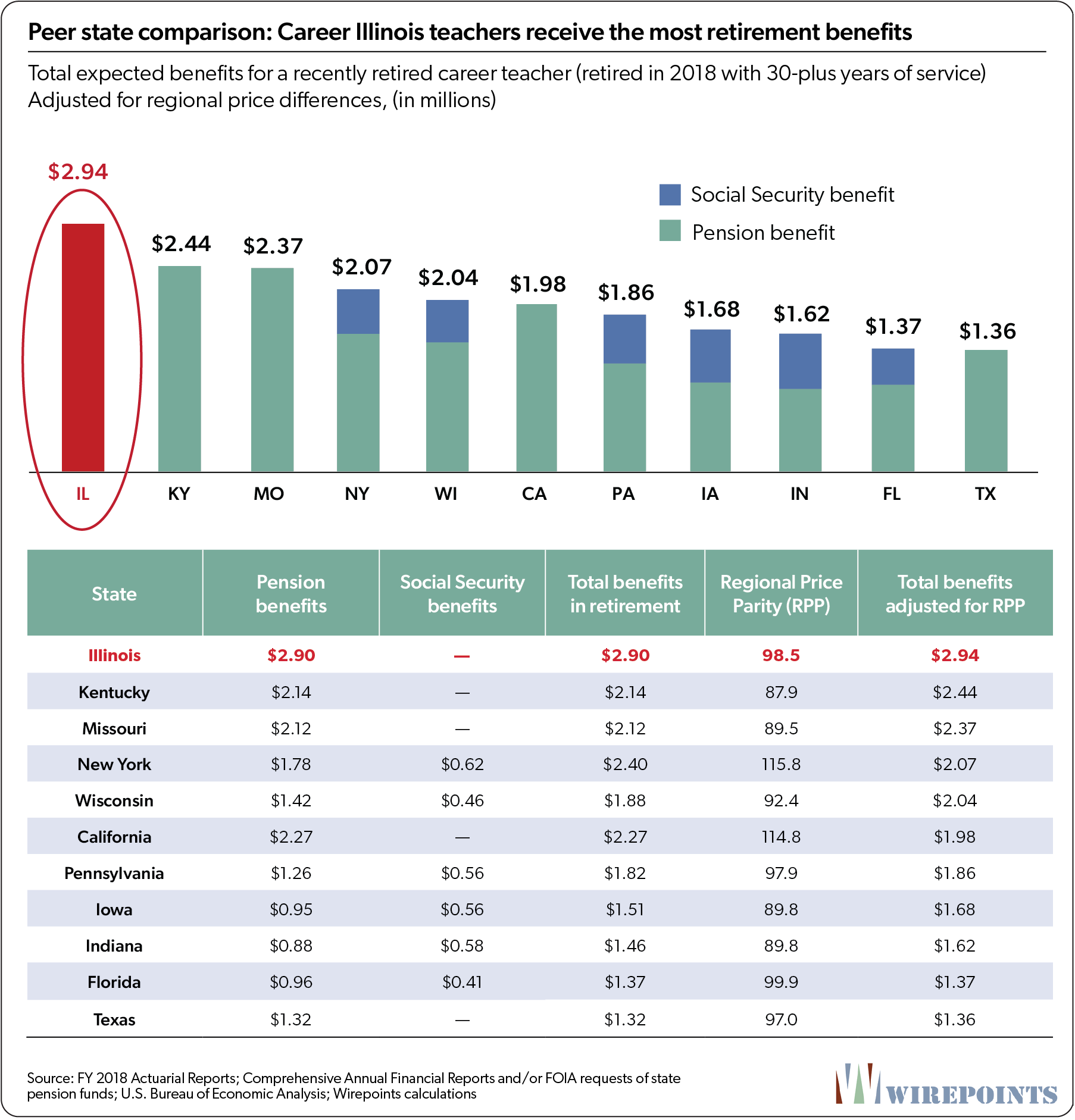

Overgenerous Pensions One Reason Why Illinois Spends So Much More On K 12 Education Than Florida Part 2 Wirepoints Wirepoints

The annual increase to be used in determining the COLA for Tier 2 is derived from the.

. Refer to the Tier 2. The 2021 Biennial Report. The pension is equal to 25 of his or her final average salary for each year of.

Message from the FPIF Executive Director. Web All IMRF Tier 2 plans have a less generous benefit structure as compared to Tier 1. Web A Tier 2 officer is eligible for retirement benefits at age 55 upon attainment of 10 years of service.

A member retires at age 60 with a monthly pension of 1800 from SERS. Web Public Act 96-0889 created a second tier for IMRFs Regular Plan. Web PENSION ESTIMATE REQUEST IMRF Form BF-20 Rev.

Web The formula to calculate a Tier 2 Regular Plan pension is. 10 years of service times 24 per year equals 24 of FAS. Web This calculator allows participants to calculate an unofficial estimated projection of a pension benefit based on information entered.

112010 The amount of your IMRF pension is based on your final rate of earnings and years and months of service. The member is also eligible for a monthly Social Security benefit of. Web Under the Level Income Option.

The annual salary maximum applicable to Tier 2 participants. Web Maximum Salary Limit and COLA for Tier II Participants 2022. The cost to provide a Tier 2 pension is more than 40 less than the cost of providing a Tier.

Web The calculations include. Web A pension formula that is based on essentially your last days rate of salary is extremely favorable to the retiring officer. 1-23 of your FRE up to the wage cap for each of the first 15 years of service credit plus 2 of your FRE up to the.

Web you need to qualify for an IMRF pension. If any of the information entered differs. Web The benefit accrual is 24 for every year of accrued service credit.

Under Regular Tier 2 you qualify for an unreduced pension at age 67 normal retirement age if you have at least 10 years of.

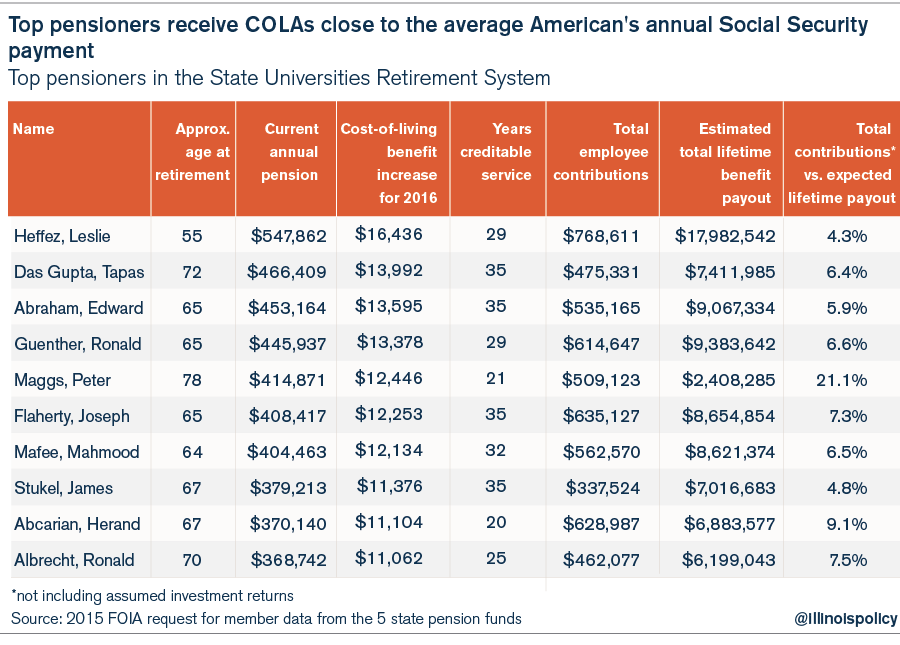

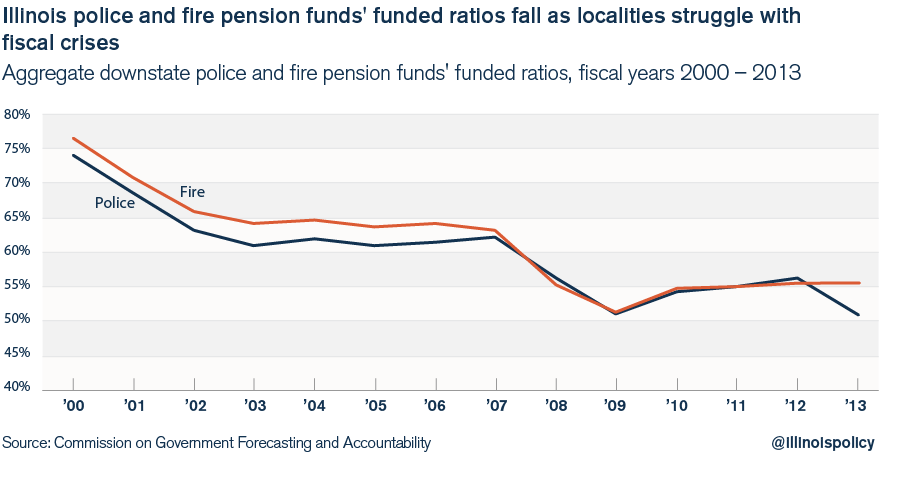

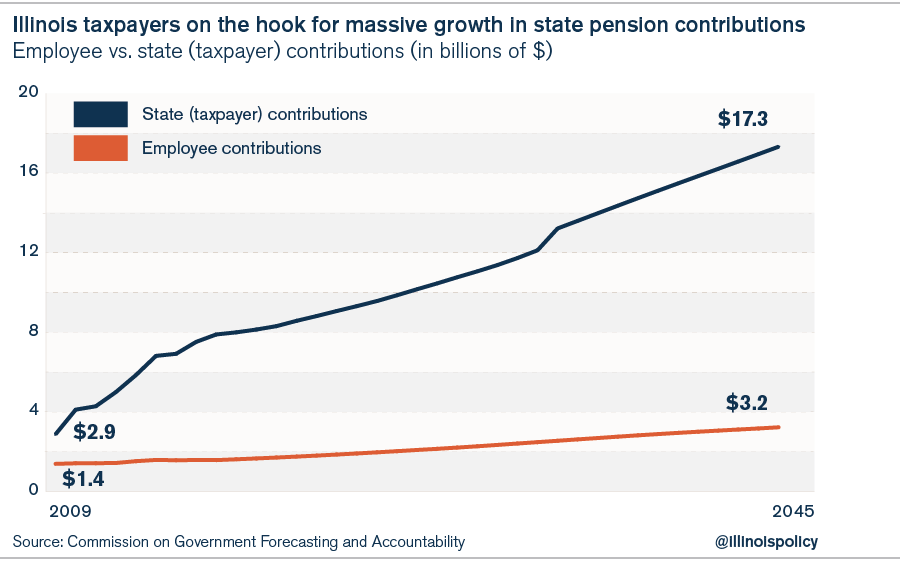

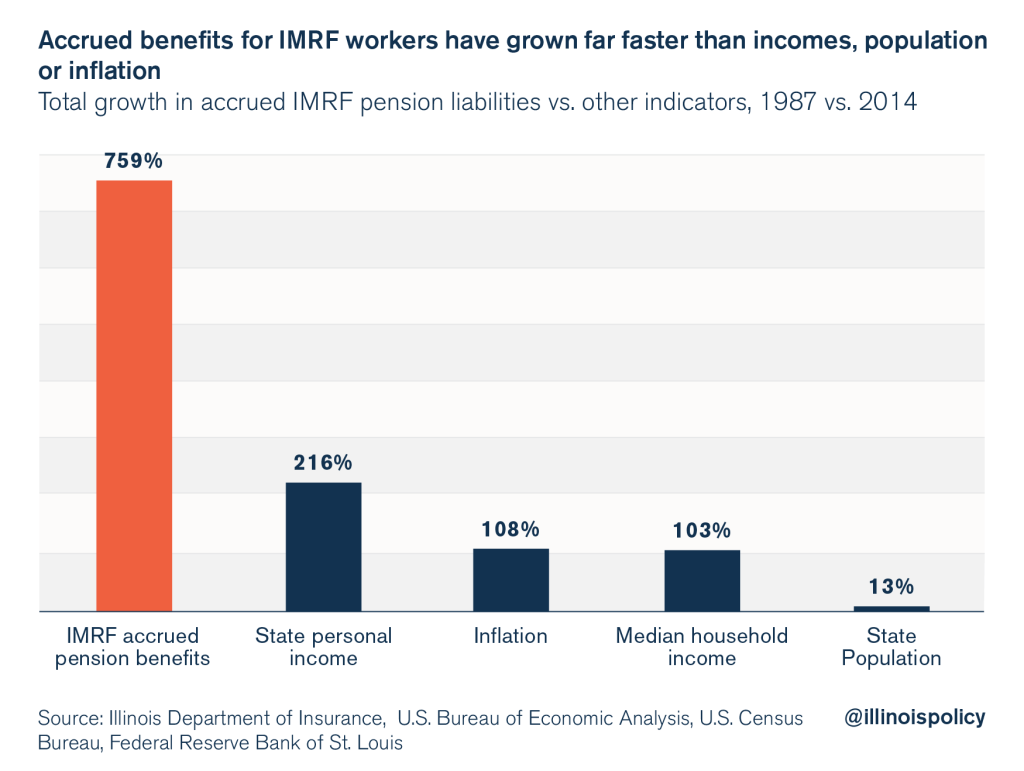

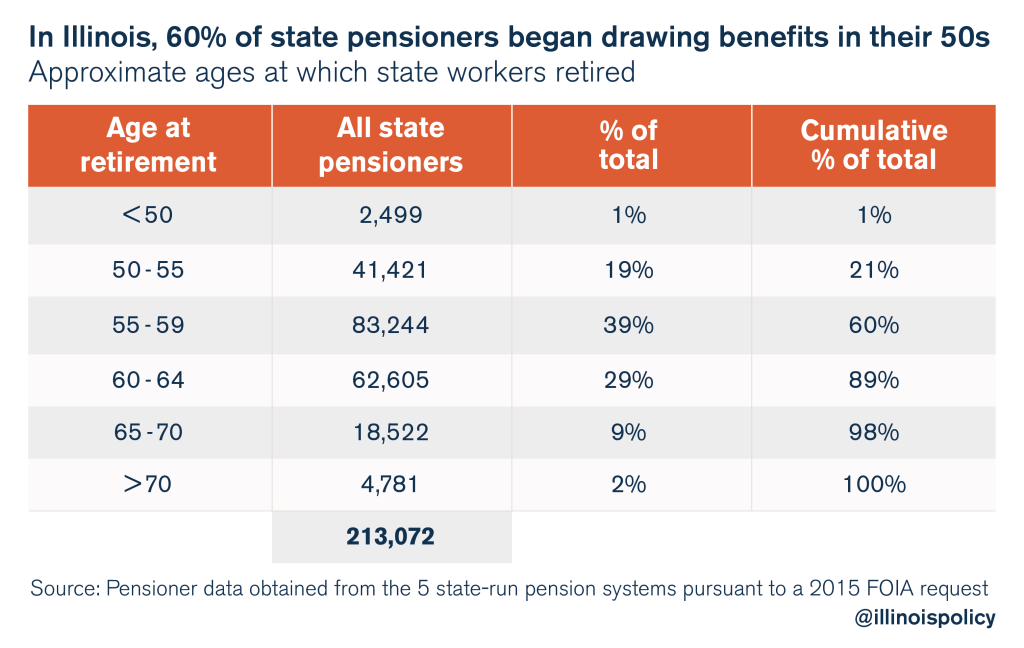

Pensions 101 Understanding Illinois Massive Government Worker Pension Crisis Illinois Policy

How To Choose German Health Insurance All About Berlin

Pension Articles Wirepoints

Defending The Indefensible Imrf Director On Pensions

Pension Calculator Contra Costa County Employees Retirement Association

Overgenerous Pensions One Reason Why Illinois Spends So Much More On K 12 Education Than Florida Part 2 Wirepoints Wirepoints

Chapter Nine Reciprocal Service Teachers Retirement System Of The State Of Illinois

Pensions 101 Understanding Illinois Massive Government Worker Pension Crisis Illinois Policy

Your Contributions

Voluntary Additional Contributions

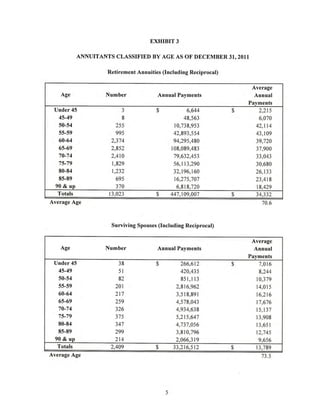

2011 Cook County Pension Fund Actuary Report

First Pension Payment

We Don T Have Actuarial Numbers Relative To This Amendment Illinois Tier 2 Pension In Their Own Words

Defending The Indefensible Imrf Director On Pensions

Defending The Indefensible Imrf Director On Pensions

Retirement Benefits

Retirement Resources Trs Imrf Surs Illinois Education Association